Tired of using your physical card for every online purchase? It's a risky game, especially for affiliate marketers and businesses juggling subscription costs and ad spend. This approach can leave you open to fraud and unexpected charges, creating a real mess for your finances.

Here at Affinco.com, we struggle with financial security. We've gone through tons of virtual card services, checking them for fraud protection, spending controls, fees, and overall bang for your buck.

This guide lays out the best options to help you protect your money and manage payments like a pro.

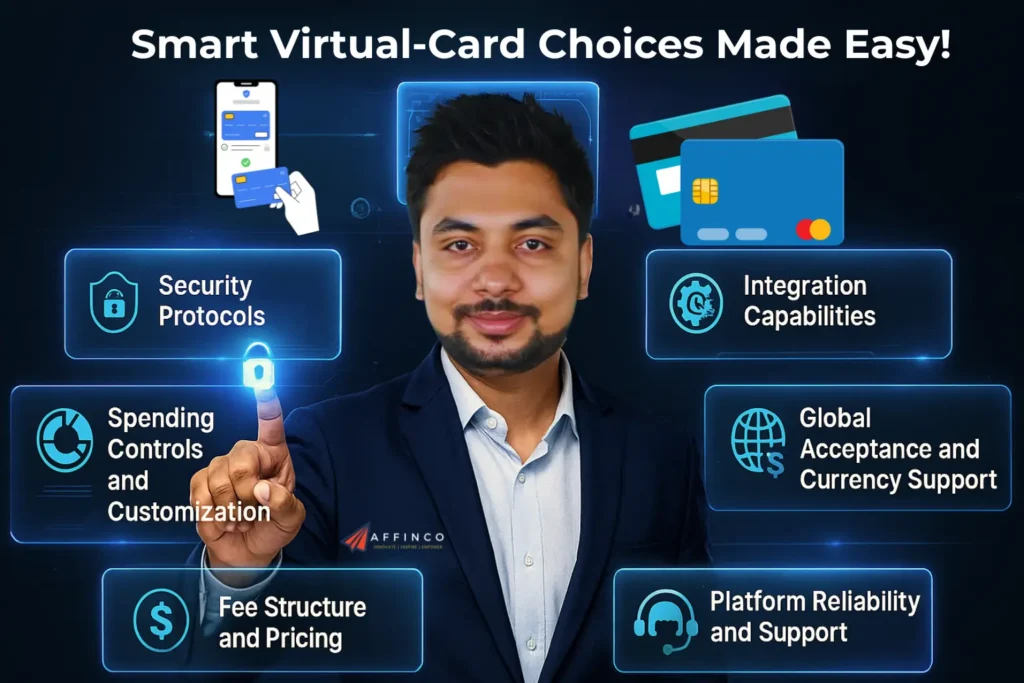

Our Evaluation Criteria: Ranking the Best Virtual Card Providers

To identify the best virtual card providers, a rigorous evaluation process is essential. Our ranking methodology focuses on several technical and financial criteria to ensure a provider offers security, control, and value.

Best Virtual Cards to Simplify Digital Payments

| ⭐ Best Virtual Cards | 💳 Card Type | 💰 Top-Up Options |

|---|---|---|

| e.PN | Virtual | Crypto (via DV.net), Capitalist, Nihaopay, WebMoney, Payeer, Perfect Money, PayPal, Alipay, Payoneer |

| MyBrocard | Virtual | Wire, USDT, Capitalist |

| Yescard | Virtual | USDT, USD |

| Volet.com | Virtual & Plastic | Multiple currencies |

| RedotPay | Virtual & Plastic | Crypto, Fiat |

| Stellar Card | Virtual | Crypto, Wire |

| FlexCard | Virtual | Crypto, Bank Transfer |

| AnyBill | Virtual | Wire, USDT |

| CardsPro | Virtual | Capitalist System |

1. e.PN

e.PN gives you a fast and reliable virtual card solution perfect for marketers, affiliates, and anyone running paid advertising campaigns. It handles everything from ad spend on Google Ads, Facebook, and TikTok to everyday online payments and subscriptions.

With over 102 BINs from banks across the US, Europe, and Latin America, you're getting solid approval rates for your advertising spend. The cards support 3DS authentication and work with both Visa and Mastercard networks. Plus, you can grab cards in different currencies to match your payment needs.

Top up your cards with crypto via DV.net (Bitcoin, Bitcoincash, Ethereum, BNB Smart Chain, Polygon, Litecoin, Tron) or through multiple payment processors including Capitalist, Nihaopay, WebMoney, Payeer, Perfect Money, PayPal, Alipay, and Payoneer. Enjoy tiered pricing—the more you spend, the lower your fees go.

e.PN Pros and Cons

Pros

Cons

Best For:

Media buyers and marketing teams running paid advertising campaigns across multiple platforms who need reliable online payment solutions.

Ratings:

(4.8/5)

Why Choose e.PN?

Choose e.PN for its massive BIN selection and flexible pricing that actually gets cheaper as your business grows. Perfect for keeping your ad accounts running without payment rejections messing up your campaigns.

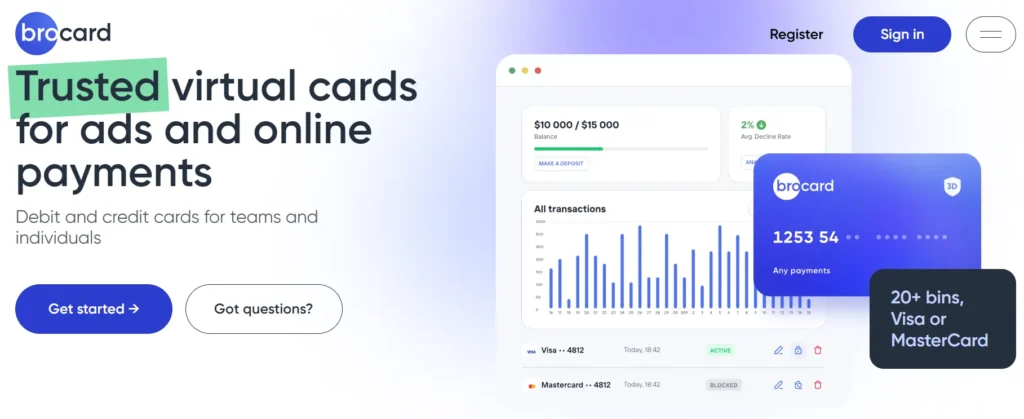

2. MyBrocard

MyBrocard provides a robust and flexible virtual card solution ideal for digital marketers, teams, and individuals who require secure and efficient online payments. It is designed to handle everything from ad spend on platforms like Google and TikTok to general online purchases and service subscriptions.

With support for over 20 trusted BINs from various banks in the US, UK, and Asia, MyBrocard ensures high acceptance rates and global reach.

The platform allows users to get their first virtual card in just five minutes, offering both USD and EURO denominations to cover diverse financial needs.

MyBrocard Pros and Cons

Pros

Cons

Best For:

Media buyers and marketing teams managing ad spend across multiple platforms.

Ratings:

(4.5/5)

Why Choose MyBrocard?

Choose MyBrocard for its reliability and extensive BIN selection, ensuring your ad campaigns run smoothly without payment issues.

3. Yescard

Yescard offers a specialized virtual card service built for media buyers and affiliate marketers. It simplifies managing ad campaigns on platforms like Facebook by providing unlimited card issuance and a unified balance, so you don't have to fund each card separately.

This solution is engineered for teamwork, allowing you to create a corporate account and invite members. With flexible spending limits and detailed financial reports, Yescard provides the control needed to manage ad spend effectively and securely.

Yescard Pros and Cons

Pros

Cons

Best For:

Media buying teams and affiliate marketers who manage multiple ad accounts.

Ratings:

(4.3/5)

Why Choose Yescard?

Choose Yescard for its specialized features that streamline ad spend management and enhance team collaboration with unlimited virtual cards.

4. Volet.com

Volet.com is a feature-rich payment platform that combines an e-wallet, cryptocurrency services, and virtual cards into a single account. It is designed for global users who need a flexible way to send, receive, and spend money online and offline.

With support for over 150 countries, Volet.com facilitates instant peer-to-peer transfers, merchant payments, and mass payouts for businesses. Users can order a plastic or virtual card to spend their balance at millions of locations worldwide, making it an excellent choice for international transactions and managing digital assets securely.

Volet.com Pros and Cons

Pros

Cons

Best For:

International users and crypto enthusiasts seeking a unified payment platform.

Ratings:

(4.2/5)

Why Choose Volet.com?

Choose Volet.com for its seamless integration of traditional finance and cryptocurrency services, offering a secure, all-in-one global payment solution.

5. RedotPay

RedotPay is a crypto payment platform that empowers users to spend their stablecoins for everyday transactions. It offers a seamless way to pay bills, shop online, or even buy coffee by converting your digital assets into spendable funds instantly.

The platform provides both virtual and physical cards that are accepted by millions of merchants worldwide. With features like a multi-currency wallet, P2P marketplace, and crypto-backed credit, RedotPay is designed to make digital finance accessible, secure, and practical for everyone.

RedotPay Pros and Cons

Pros

Cons

Best For:

Crypto enthusiasts who want to use their digital assets for daily purchases.

Ratings:

(4.0/5)

Why Choose RedotPay?

Choose RedotPay to seamlessly integrate your crypto holdings with real-world spending, backed by a secure and user-friendly platform.

6. Stellar Card

Stellar Card is an exclusive, invite-only virtual card service built for serious media buying teams and advertising agencies. It provides a secure and efficient way to manage ad spend on platforms like Facebook and Google, with a strong focus on maintaining high-quality, private BINs to minimize risks.

The platform is engineered for speed and scale, offering advanced features like bulk card actions, role-based team controls, and a shared balance to eliminate manual top-ups. With its clean interface and robust analytics, Stellar Card allows teams to manage their finances with precision and clarity.

Stellar Card Pros and Cons

Pros

Cons

Best For:

Established media buying teams and ad agencies with significant ad spend.

Ratings:

(4.7/5)

Why Choose a Stellar Card?

Choose Stellar Card for its premium, reliable service and features built specifically to support high-level advertising and media buying operations.

7. FlexCard

FlexCard is a virtual card service built with the specific needs of affiliate marketers in mind. It offers instant and unlimited card issuance, allowing users to quickly generate non-personalized debit cards that enhance anonymity for online campaigns.

The platform supports a wide range of BINs from popular European and American GEOs, and you can top up your account with cryptocurrency or bank transfers. A standout feature is that FlexCard returns the top-up fee when you withdraw funds, adding a unique layer of value for users managing their budgets.

FlexCard Pros and Cons

Pros

Cons

Best For:

Affiliate marketers who need a high volume of cards and flexible funding options.

Ratings:

(4.4/5)

Why Choose FlexCard?

Choose FlexCard for its unlimited card issuance, flexible top-up options, and the unique benefit of getting your top-up fees back.

8. AnyBill

AnyBill provides a robust and reliable virtual card platform designed for both individuals and teams. If you're paying for online advertising, shopping for retail goods, or managing subscriptions, AnyBill offers a seamless payment experience.

With a focus on ease of use, the platform features immediate card issuance, a single balance for all your cards, and transparent pricing with no hidden fees. AnyBill also supports Apple & Google Pay, making it a versatile choice for both online and in-person transactions.

AnyBill Pros and Cons

Pros

Cons

Best For:

Media buyers and individuals needing a reliable, all-in-one card solution.

Ratings:

(4.6/5)

Why Choose AnyBill?

Choose AnyBill for its expert support in ad spend, high attachment rates, and user-friendly platform with transparent fees.

9. CardsPro

CardsPro offers a specialized virtual card solution created for the affiliate marketing industry. Backed by the trusted Capitalist payment system, it provides a robust platform for media buying departments, affiliate teams, and even individuals making worldwide online purchases.

The service allows for the free and instant issuance of multiple cards without complex verification. With features like automatic replenishment when a card's balance is low and BINs from various GEOs, CardsPro is designed to optimize advertising campaigns and streamline payment processes for business.

CardsPro Pros and Cons

Pros

Cons

Best For:

Affiliate marketing teams and businesses that use the Capitalist payment system.

Ratings:

(4.3/5)

Why Choose CardsPro?

Choose CardsPro for its seamless integration with the Capitalist system, which provides a professional and efficient solution for managing ad spend.

Common Mistakes to Avoid When Using Virtual Cards

While virtual cards offer significant advantages, users can make mistakes that undermine their effectiveness. Avoiding these common pitfalls is key to maximizing the security and financial benefits of the best virtual card services.

Protect Your Payments

To conclude, virtual payment cards present a strong method for securing online transactions and managing expenditures with precision. They provide critical control over spending for personal use and complex business requirements, such as advertising.

While providers offer different features, from team functions to crypto support, the best choice aligns with your financial objectives.

This guide has equipped you with the details needed to select a solution that safeguards your money and streamlines your digital payment process, ensuring greater financial safety.

Ali

Ali is a digital marketing expert with 7+ years of experience in SEO-optimized blogging. Skilled in reviewing SaaS tools, social media marketing, and email campaigns, we craft content that ranks well and engages audiences. Known for providing genuine information, Ali is a reliable source for businesses seeking to boost their online presence effectively.