Cryptocurrency global crypto market cap currently sits at $3.1 trillion as of late 2025, with over 560 million people worldwide holding digital assets. Bitcoin reached $115,970 in 2025, while 28% of US adults (65 million people) now own some form of cryptocurrency.

For investors, traders, and financial analysts, fresh Cryptocurrency Statistics reveal the secrets behind this multi-trillion-dollar blockchain economy heading into 2026.

We've collected the latest market data, adoption rates, and trading volumes that reveal exactly where crypto users put their money and which digital currencies dominate portfolios in 2026.

Out of 17,151 existing cryptocurrencies, only 10,385 are actively traded – meaning over 6,000 digital tokens are essentially dormant.

Cryptocurrency Statistics: Global Market Overview

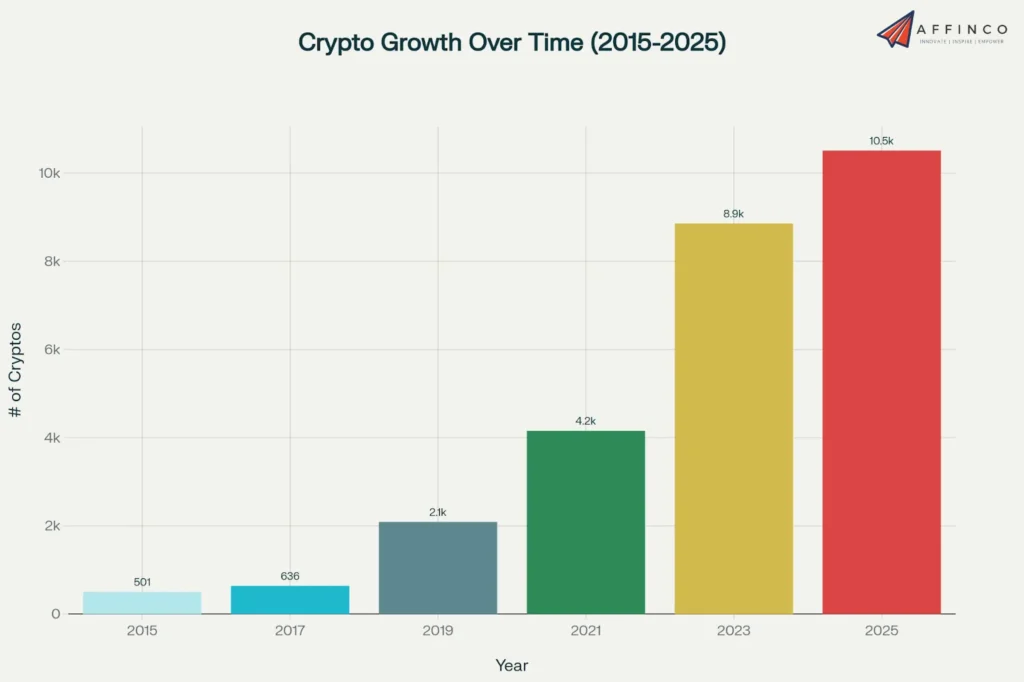

Proliferation of Cryptocurrencies

The number of cryptocurrencies has surged since Bitcoin's inception, creating a vast and diverse digital asset ecosystem. This explosion of new coins and tokens reflects a high level of innovation, though not all projects succeed.

| Year | Number of Cryptocurrencies |

|---|---|

| 2015 | 501 |

| 2017 | 636 |

| 2019 | 2,086 |

| 2021 | 4,154 |

| 2023 | 8,856 |

| 2025 | 10,510 |

Sheer quantity of digital currencies highlights a period of intense experimentation. This growth also comes with a high rate of project failure, a key consideration for participants.

Cryptocurrency Market Size Trajectory

Historical view of the market's valuation reveals a story of exponential growth, punctuated by periods of sharp correction. The overall trend demonstrates a consistent increase in total market value over the past decade.

The market's 2026 trajectory depends heavily on institutional adoption, regulatory clarity, and macroeconomic conditions. Its future growth appears steady, even when accounting for inherent volatility.

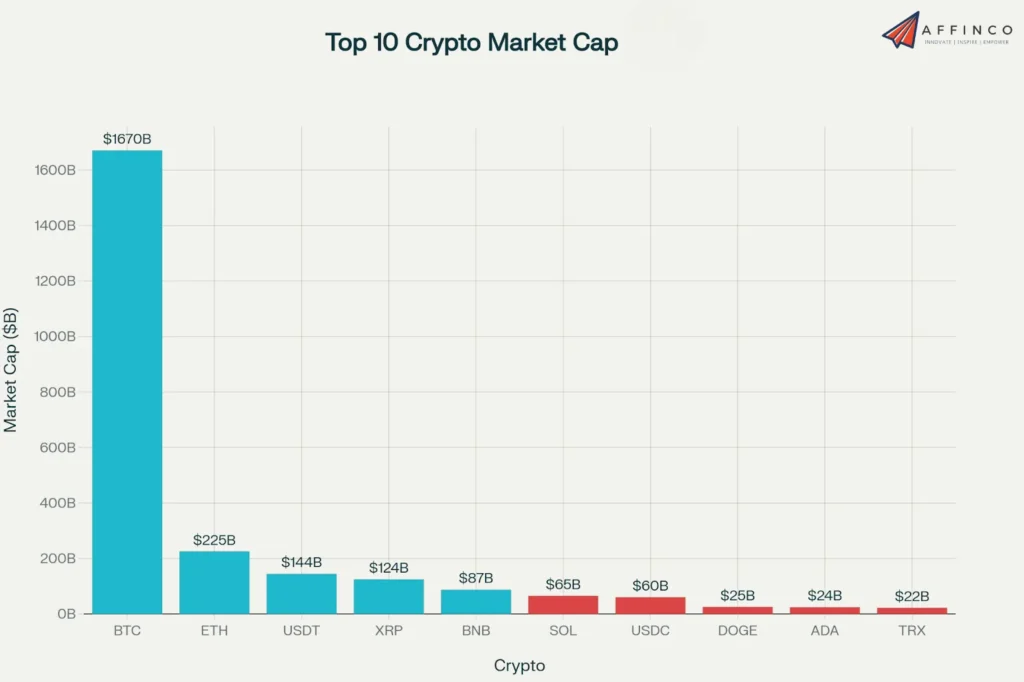

Top Cryptocurrencies by Market Cap

Few major players dominate the market, with Bitcoin and Ethereum leading the pack by a significant margin. This concentration shows where the majority of capital and investor confidence is currently allocated.

| Rank | Cryptocurrency | Symbol | Market Cap (USD Billion) |

|---|---|---|---|

| 1 | Bitcoin | BTC | $1,670 |

| 2 | Ethereum | ETH | $225 |

| 3 | Tether | USDT | $144 |

| 4 | XRP | XRP | $124 |

| 5 | BNB | BNB | $87 |

| 6 | Solana | SOL | $65 |

| 7 | USD Coin | USDC | $60 |

| 8 | Dogecoin | DOGE | $25 |

| 9 | Cardano | ADA | $24 |

| 10 | TRON | TRX | $22 |

The concentration of value in the top assets shows where investor confidence lies. Stablecoins also play a crucial role in the health of the trading ecosystem.

Cryptocurrency Exchange Landscape

As the market has grown, so has the infrastructure supporting it, with hundreds of exchanges facilitating billions in daily trades. These platforms are the primary gateway for most users to access digital assets.

The exchange market is highly competitive, providing users with numerous options for trading. High trading volumes point to a liquid and active market.

Geographic Crypto Adoption

Cryptocurrency adoption is a global phenomenon, with certain regions and countries leading the charge. This geographic breakdown shows where grassroots adoption and high-volume trading are most prevalent.

Emerging markets, particularly in Asia, are hotspots for cryptocurrency adoption. This highlights crypto's role in regions with different financial structures and needs.

Bitcoin Statistics: The Market Leader

As the original cryptocurrency, Bitcoin's performance and metrics often serve as a bellwether for the entire market. Its statistics are watched closely by investors everywhere.

- Bitcoin's price reached an all-time high of over $115,970 on September 14, 2025.

- Its market capitalization stood at $2.247 trillion as of September 22, 2025, which represents an 80.43% increase from one year ago.

- Over 19.89 million BTC are now in circulation, making up 95% of its finite maximum supply of 21 million.

- The approval and growth of Bitcoin ETFs have been a major factor in its recent performance, with these funds now holding over 5% of Bitcoin's total circulating supply.

- Looking ahead to 2026, analysts forecast Bitcoin could trade in a range between $100,000 and $140,000 in a base case scenario, with bullish projections reaching $174,000-$200,000.

- Institutional holdings are expected to reach approximately 20% of total Bitcoin supply (4.2 million BTC) by the end of 2026.

Bitcoin's fixed supply and increasing institutional interest continue to be strong value drivers. Its dominance is a key feature of the crypto market structure.

Decentralized Finance (DeFi) Growth

The DeFi sector has seen remarkable growth, creating an alternative financial system on the blockchain.

DeFi's rapid expansion points to strong demand for permissionless financial services. The growth in TVL is a primary indicator of the sector's health and user trust.

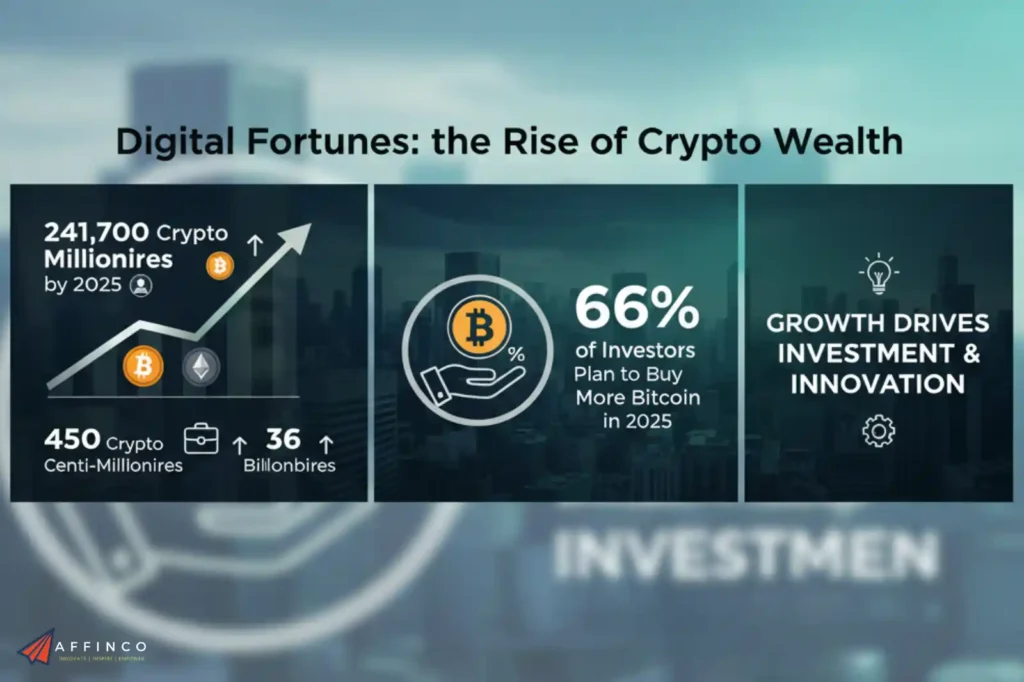

Cryptocurrency Investment and Wealth

Digital assets have become a significant vehicle for wealth creation, minting a new class of millionaires and billionaires. This aspect of the market has attracted considerable media attention and further investment.

The wealth generated in the crypto space is substantial and growing. This attracts further investment, talent, and development into the industry.

Risks and Cryptocurrency Failures

High-reward nature of cryptocurrency comes with significant risks, including a very high rate of project failure. For every successful project, many others fade into obscurity.

The high failure rate serves as a stark reminder of the speculative nature of many crypto projects. Investor caution is necessary when navigating this space.

| Year of Launch | Number of Dead Coins | Failure Rate for Cohort |

|---|---|---|

| 2017 | 346 | 70% |

| 2018 | 1,104 | 70% |

| 2020 | 1,806 | Moderate |

| 2021 | 5,724 | 70% |

| 2022 | 3,520 | 60% |

Blockchain Technology Market

The underlying technology of cryptocurrencies, blockchain, is a booming market in its own right with wide-ranging applications. Its potential is being explored in finance, supply chain management, healthcare, and more.

- The global blockchain technology market is valued at $41.15 billion in 2025.

- It is projected to expand at a CAGR of 52.90% to reach an astonishing $1,879.30 billion by 2034.

- Currently, 10% of global businesses have already integrated blockchain technology in some form.

- The U.S. blockchain market is a significant part of this, expected to grow from $8.70 billion in 2024 to $619.28 billion by 2034.

Blockchain's potential extends far beyond finance, promising to add efficiency and transparency to numerous industries. The market's growth forecast reflects this broad utility.

Regulatory Environment Heading into 2026

Legal and regulatory frameworks surrounding crypto are maturing, providing clearer rules for businesses and investors. This evolution is crucial for the industry's long-term stability and growth.

A more defined regulatory approach is taking shape, which could foster greater mainstream adoption. Building public trust in governmental oversight remains a key challenge.

Cryptocurrency Market Volatility

Sharp price swings are a defining characteristic of the crypto market, creating both considerable risk and opportunity. This volatility is a key reason for the high levels of interest from traders.

Volatility remains a key factor for anyone involved in the crypto market. The scale of liquidations highlights the high stakes of leveraged trading in this environment.

Conclusion

Crypto millionaires jumped to 241,700 globally while DeFi protocols locked $170 billion in smart contracts, proving digital assets create real wealth beyond speculation.

APAC markets exploded 69% year-over-year, with India claiming top adoption rankings for three consecutive years through 2025. Regulatory frameworks are gaining clarity heading into 2026 as institutional investors poured billions into Bitcoin ETFs.

Blockchain developers in emerging markets now outnumber traditional finance hubs, shifting crypto growth from Silicon Valley to Global South economies. Stablecoin usage surged 900% while trading volumes hit multi-trillion-dollar milestones across 217 active exchanges.

With analysts projecting Bitcoin could reach $174K-$200K and total crypto market cap potentially hitting $10-12 trillion by end of 2026, will your investment portfolio capture even 1% of this wealth creation surge?

Ali

Ali is a digital marketing expert with 7+ years of experience in SEO-optimized blogging. Skilled in reviewing SaaS tools, social media marketing, and email campaigns, we craft content that ranks well and engages audiences. Known for providing genuine information, Ali is a reliable source for businesses seeking to boost their online presence effectively.