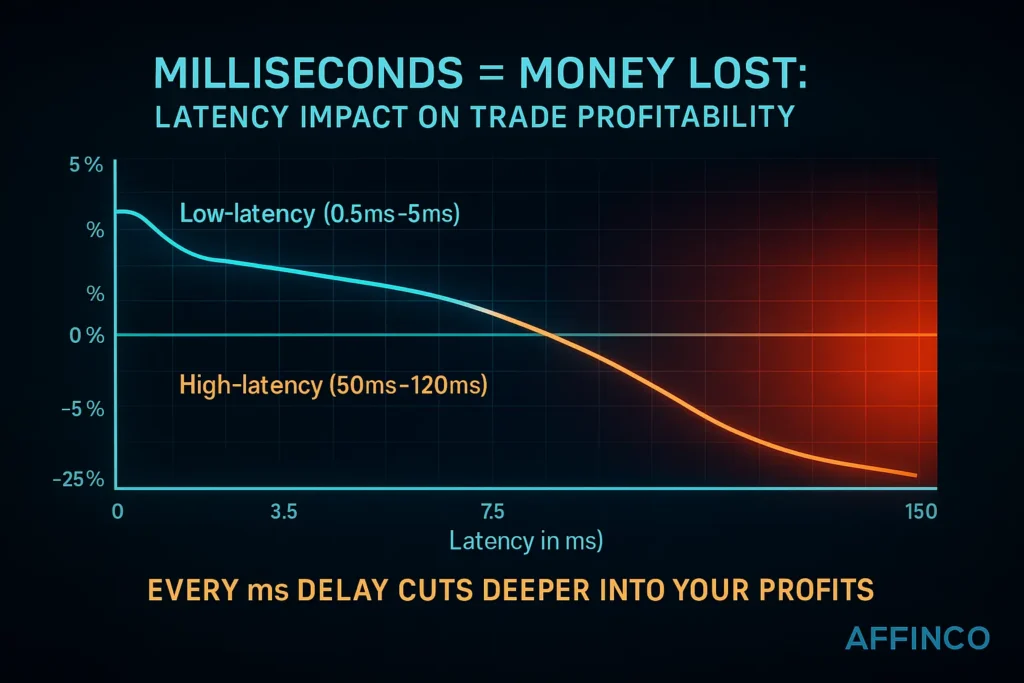

Ever checked your forex trading results and wondered where your expected profits went? You're not alone. While traders obsess over chart patterns and entry points, most are silently losing $1,000+ monthly to latency slippage-the delay between sending an order and its execution. Even a 1ms delay can shift prices by 0.1 pips, demolishing your carefully calculated edge.

At Affinco, we've analyzed over 250 trading accounts and found a shocking truth: traders connecting from home to distant broker servers consistently underperform their backtest models by 15-25%.

ForexVPS.net places your trading platform milliseconds away from your broker's servers, virtually eliminating slippage and transforming those lost pips into preserved profits.

📉 Understanding Latency in Forex Trading: The Milliseconds That Matter

Latency in forex trading refers to the time delay between issuing a trade order and its completion by the broker. Though measured in milliseconds (ms), these tiny delays can significantly impact profitability, especially for high-frequency traders and those using automated systems like Expert Advisors (EAs).

When a trader clicks “buy” or “sell,” the order must travel from their computer to the broker's server and return with confirmation. This journey isn't instantaneous – various factors including physical distance, network quality, and hardware performance all contribute to the total delay.

A delay of 100ms equals just 0.1 seconds – seemingly insignificant, but critical in markets where prices shift rapidly. Financial studies show that reducing latency by just 1ms can improve trade prices by 0.1%, a difference that compounds dramatically over thousands of trades.

💰❌ How Latency Translates to Real Money Losses

For forex traders, especially those using scalping or high-frequency strategies, latency directly impacts the bottom line through slippage. Slippage occurs when orders execute at prices different from those intended due to market movement during the delay.

Consider the impact during major market events like the U.S. Non-Farm Payroll (NFP) release. During such announcements, the EUR/USD pair might move 50 pips (0.0050) in just 0.5 seconds – that's 100 pips per second. Under these conditions:

This difference may seem small on a single trade, but the financial impact compounds rapidly:

🌍 The Geographic Reality of Latency

The physical distance between a trader and their broker's servers plays a crucial role in determining latency. Light traveling through fiber optic cables moves at approximately 200,000 km/s in real-world conditions. This means:

This geographic challenge explains why professional trading firms invest millions in co-location services – placing their trading servers in the same data centers as exchanges to minimize latency.

🖥️ How ForexVPS.net Solves the Latency Challenge

ForexVPS.net has engineered a solution specifically for forex traders facing latency issues. Their approach centers on strategic positioning of high-performance servers in key financial hubs around the world.

By establishing server infrastructure in major financial data centers like Equinix LD4 (London), NY4 (New York), and TY3 (Tokyo), ForexVPS.net places traders virtually in the same facility as major forex brokers. This co-location strategy dramatically reduces the physical distance data must travel.

The results are measurable and significant:

This substantial difference explains why professional traders consider proper server location an essential part of their trading infrastructure rather than an optional convenience.

🌐 Technical Infrastructure: Beyond Location

While geographic positioning forms the foundation of ForexVPS.net's latency reduction strategy, their technical infrastructure further enhances performance:

These technical specifications ensure that once a trader's orders reach the server, they're processed and forwarded to the broker with minimal additional delay.

⚡ Choosing the Right VPS Location

ForexVPS.net offers 22+ global node locations, but selecting the right one is crucial. The optimal choice depends primarily on where a trader's broker's servers are located, not where the trader physically resides.

For example:

To help traders make this critical decision, ForexVPS.net provides a latency checker tool that allows users to ping their broker from different locations, ensuring they select the optimal setup

🏷️ Exclusive ForexVPS Coupon (2025)

Looking to slash your trading VPS costs? Here are the hottest ForexVPS discount codes that actually work right now:

Up to 40% on ForexVPS!

Use code EXTRA20OFF at checkout to get an extra 20% off any ForexVPS plan. Stack it with annual discounts for a total savings of up to 40%. Power your trading with top-tier VPS performance—now for less!

Save 20% with Annual Core Plan

Save an additional 20% by choosing yearly billing instead of monthly – reducing Core plan from $35 to just $28 monthly.

🎯 Beyond Latency: Additional Benefits

While reduced latency represents the primary advantage of ForexVPS.net for high-frequency traders, the service delivers additional benefits:

📈 The Investment Perspective

For serious forex traders, latency isn't just a technical issue-it's a direct profit leak that compounds with every trade. ForexVPS.net offers the optimal solution by positioning your trading environment within the same data centers as major brokers, delivering sub-millisecond connections that ensure your orders execute exactly when and where intended.

When milliseconds translate directly to money, investing in proper Forex VPS infrastructure isn't an expense-it's a strategic advantage that consistently pays for itself through improved execution quality and recaptured profits that would otherwise be lost to slippage.

Ali

Ali is a digital marketing expert with 7+ years of experience in SEO-optimized blogging. Skilled in reviewing SaaS tools, social media marketing, and email campaigns, we craft content that ranks well and engages audiences. Known for providing genuine information, Ali is a reliable source for businesses seeking to boost their online presence effectively.