Web hosting is a critical pillar of digital marketing, fueling everything from personal blogs to global e-commerce. With over 1.1 billion websites online and new ones emerging every minute, the industry’s size and innovation are nothing short of stunning.

In fact, the global web hosting services market is projected toreach nearly $200 billion in revenue in 2026. If you’re managing multiple domains or just curious about cloud hosting’s epic rise, these web hosting statistics for 2026 deliver the context and insights you need.

ℹ️ Fun fact: Nearly 175 new websites are created every minute—meaning more than 250,000 websites go live every single day! Bold figures, giant numbers, and some real server drama ahead. Let’s get started.

The Big Picture: Core Web Hosting Market Statistics 2026

Global Web Hosting Market Overview

Market Size and Growth Projections

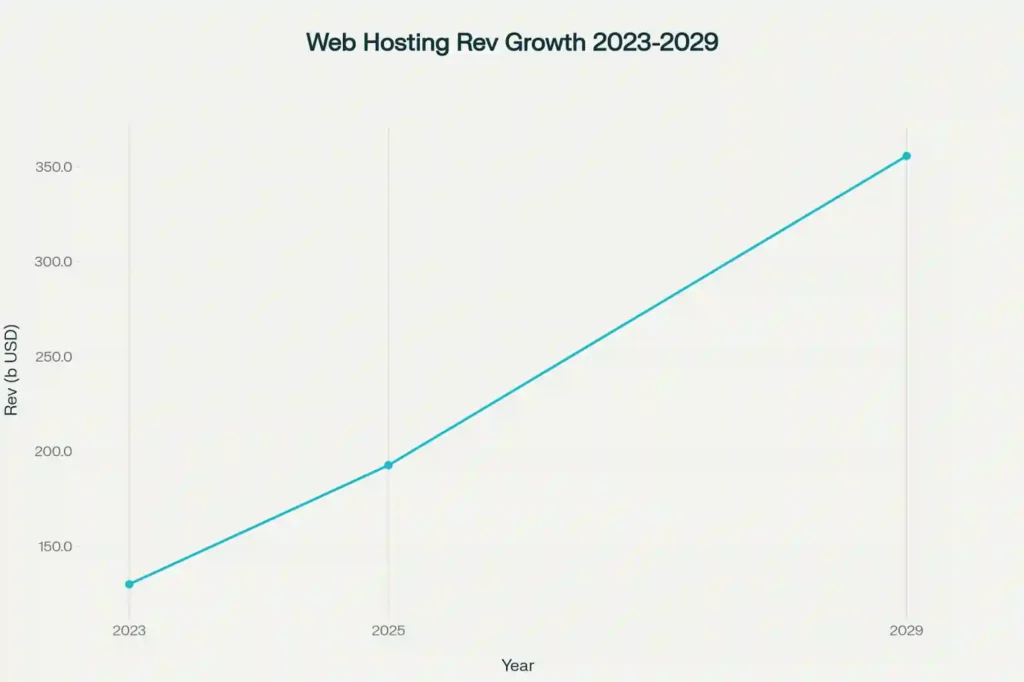

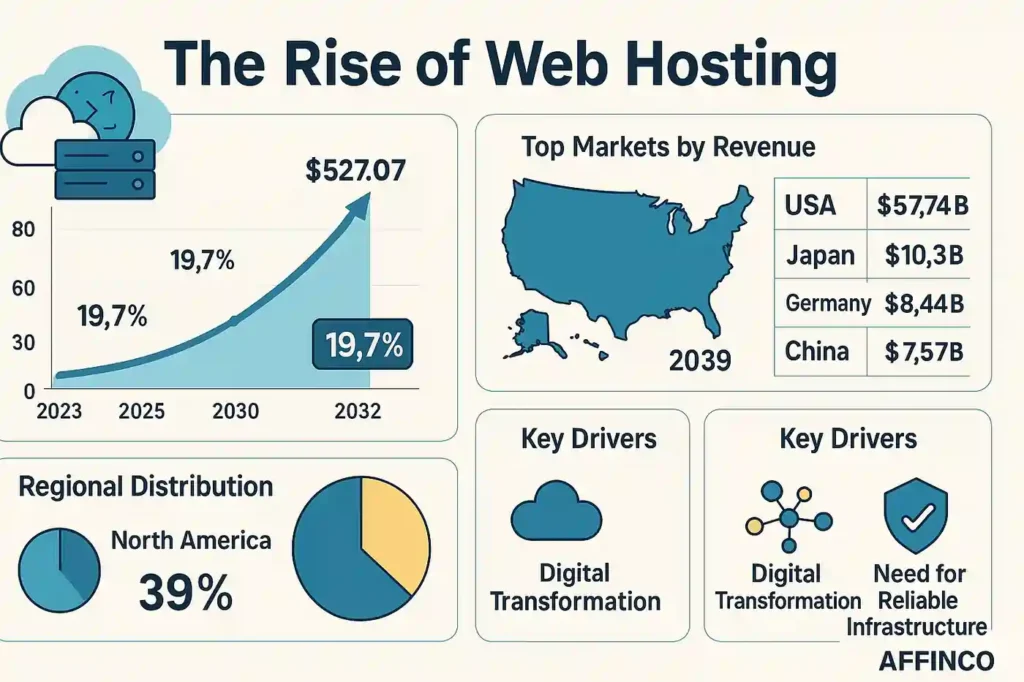

The web hosting services market has experienced unprecedented growth in recent years. The global market was valued at $88.41 billion in 2023 and is projected to reach $320.62 billion by 2030. The market size reached $192.85 billion in 2026, representing substantial year-over-year growth.

Market growth projections show impressive expansion across different timeframes:

The industry is experiencing a compound annual growth rate (CAGR) of 19.7% through 2032, driven by increasing cloud adoption, digital transformation initiatives, and the growing need for reliable online infrastructure.

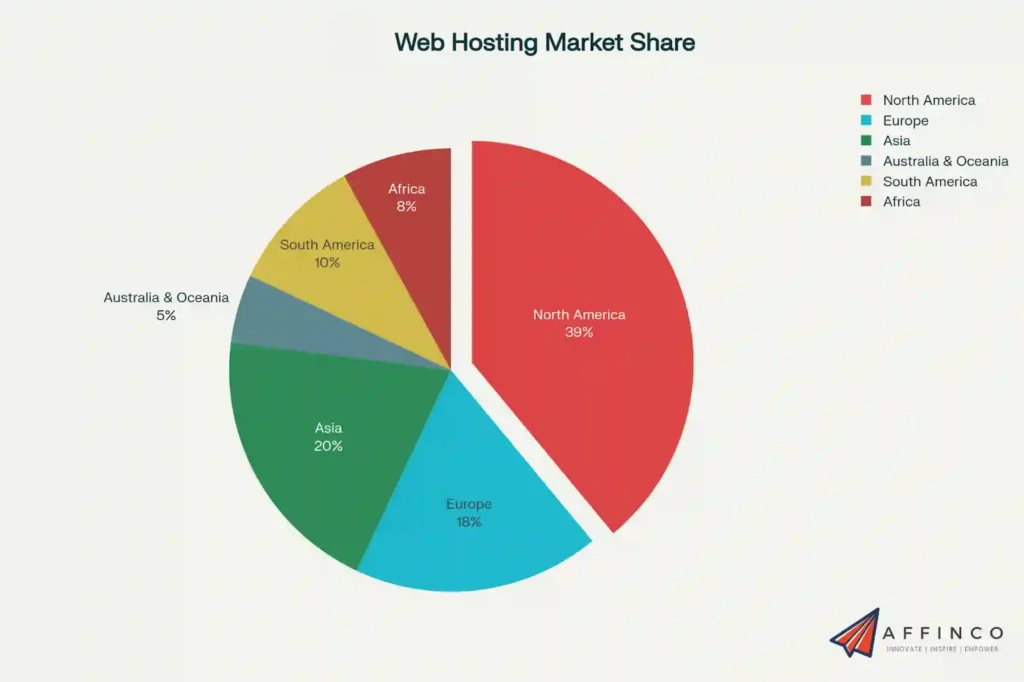

Regional Market Distribution

North America dominates the global web hosting market, expected to account for 39% of the global market share in 2026. The United States specifically will generated $57.74 billion in revenue in 2024, making it the largest single market globally.

Top countries by web hosting revenue:

The U.S. web hosting market alone is forecasted to grow from $44.75 billion in 2025 to $127.17 billion by 2029, representing a CAGR of 23.5%.

Web Hosting Market Share by Providers

Leading Cloud Hosting Providers

Amazon Web Services (AWS) maintains its position as the industry leader with a 33.6% market share in the web hosting industry. AWS hosts 5.8% of all websites globally and powers over 124 million websites worldwide.

Top cloud hosting providers by market share:

Traditional Web Hosting Companies

Beyond cloud giants, traditional hosting companies maintain significant market presence:

The top 10 hosting providers collectively account for 33.6% of the global market, demonstrating significant market concentration among major players.

Types of Web Hosting Services

Shared Hosting Dominance

Shared hosting remains the most popular hosting type, representing 35.2% of the web hosting services industry in terms of revenue. This hosting segment is expected to reach $70.6 billion by 2026.

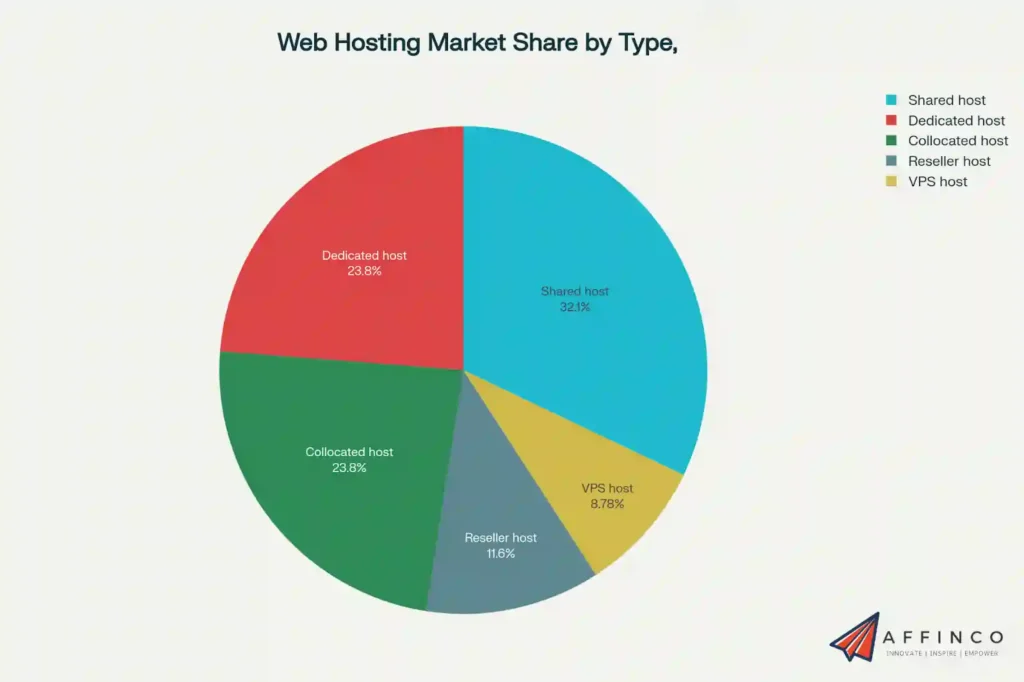

Web hosting types by market share:

Shared hosting plans typically cost between $2.51 and $4.63 per month, making them accessible to small businesses and individual website owners.

Cloud Hosting Growth

Cloud hosting is experiencing the fastest growth with an 18.3% annual growth rate, The segment is driven by scalability demands and enterprise adoption of multi-cloud strategies.

Multi-cloud hosting statistics:

Dedicated Hosting Market

The dedicated hosting services industry was valued at $14.26 billion in 2022 and will reach $47.93 billion by 2029, growing at a CAGR of 18.9%. Dedicated hosting typically costs between $80-$500 per month, targeting enterprises requiring maximum performance and control.

Web Server and Technology Statistics

Web Server Market Share

Nginx leads the web server market, powering 34.3% of all websites globally. The competition among web servers remains intense:

- Nginx: 37% of all websites

- Apache: 25-30.2% of websites

- Cloudflare Server: 21.8%

- LiteSpeed: 12.9%

- Microsoft-IIS: 10%

Content Management Systems

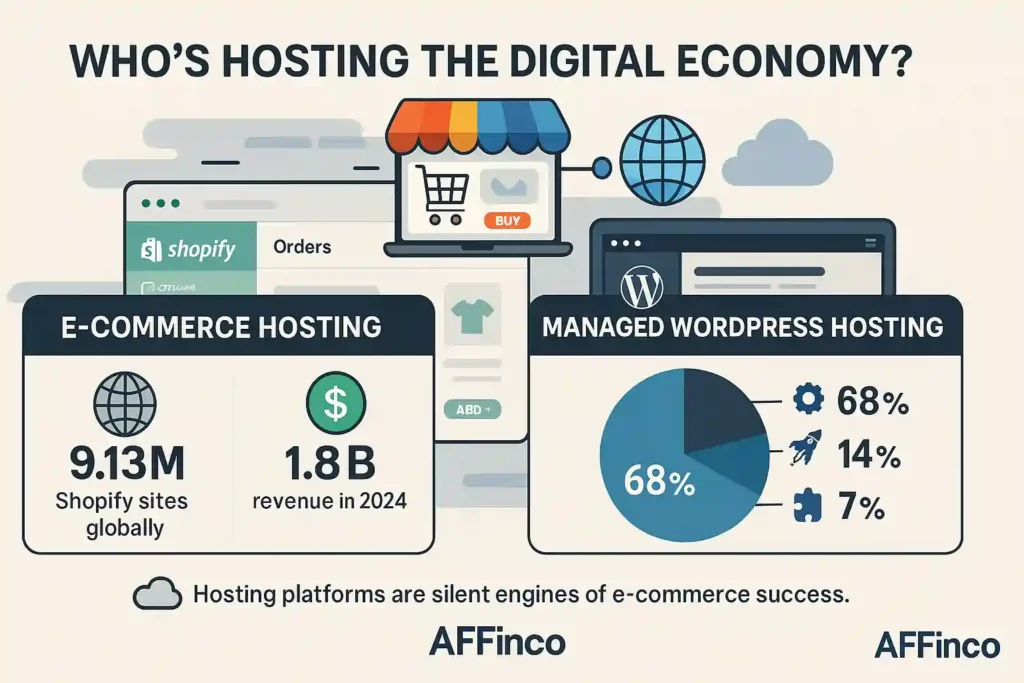

WordPress hosting dominates the CMS marketplace, with 43.3% of all websites using WordPress. This has created a substantial market for managed WordPress hosting services.

Popular CMS platforms:

- WordPress: 43.3%

- Shopify: 4.3%

- Wix: 2.6%

- Squarespace: 2.1%

- Joomla: 1.7%

Programming Languages: PHP remains the dominant server-side language, used by 76.4% of all websites, demonstrating the continued importance of traditional web technologies alongside modern frameworks.

Domain Registration and Website Statistics

Global Website Numbers

There are currently over 1.11 billion websites worldwide, though only 17% are active. This means approximately 193.89 million websites are actively maintained, while 925.13 million remain inactive.

Website creation rate:

- 175 new websites created every minute

- 252,000 new websites launched daily

- Over 571.9 million websites use web hosting services globally

Domain Market Share

The .com domain maintains overwhelming dominance with 45.2% of all websites using this top-level domain.

Top domain extensions by market share:

GoDaddy leads domain registration with over 84 million registered domains, cementing its position as the top domain registrar globally.

Web Hosting Industry Revenue and Economics

Revenue Growth Trends

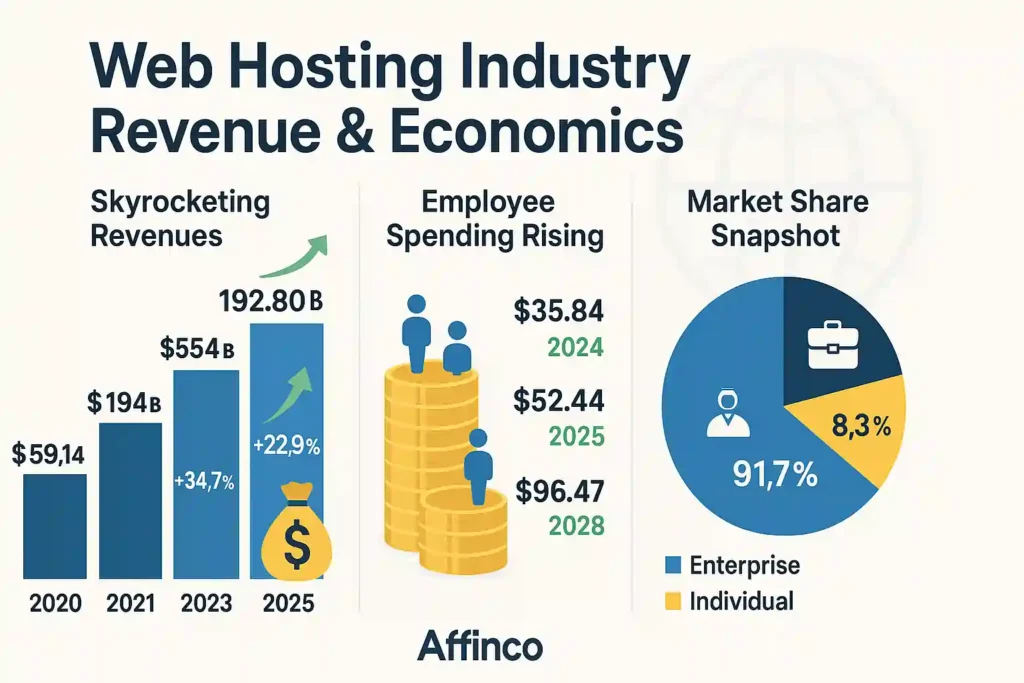

The web hosting industry revenue has shown remarkable growth momentum. The global industry generated $159.90 billion in 2024 and is projected to cross $192.80 billion in 2026, representing a 20.57% year-over-year increase.

Historical revenue growth:

Employee Spending Patterns

The global web hosting industry spends an average of $35.84 per employee, with projections showing this will increase to $96.47 by 2028. The average spend per employee in 2026 is expected to reach $52.44 globally.

Enterprise vs Individual Market

Enterprise web hosting dominated the market in 2022, representing 91.7% of the total market, while individual-based hosting accounts for the remaining 8.3%. This demonstrates the industry's focus on business-to-business services and enterprise solutions.

Web Hosting Uptime and Reliability Statistics

Data Center Outages

Uptime statistics reveal critical insights about hosting reliability:

Performance Expectations

Website performance remains critical, with 47% of users expecting a site to load in 2 seconds or less. This puts pressure on hosting providers to deliver consistently high performance and reliability.

Uptime benchmarks:

Regional Web Hosting Insights

Server Location Distribution

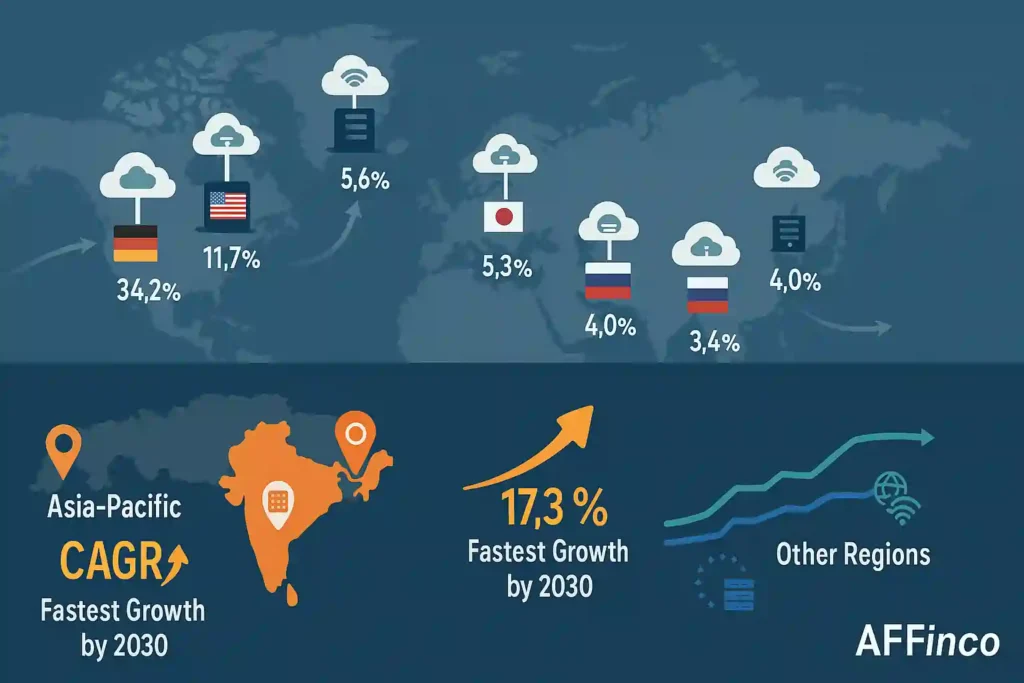

The United States hosts 34.2% of all web servers globally, making it the dominant location for web infrastructure.

Top countries by server location:

Regional Growth Patterns

Asia-Pacific is projected to be the fastest-growing region with a 17.3% CAGR through 2030, driven by large-scale data center projects in India and China. Europe and other regions continue to show steady growth as digital transformation accelerates globally.

E-commerce and Specialized Hosting

E-commerce Hosting Growth

E-commerce hosting represents a significant growth segment:

Managed WordPress Hosting

Managed WordPress hosting has become increasingly popular:

Future Trends and Market Outlook

Emerging Technologies

The web hosting market is evolving rapidly with new technologies:

Market Challenges

Energy costs and infrastructure limitations pose challenges:

Conclusion: Actionable Insights from 2026’s Top Web Hosting Statistics

The web hosting industry in 2026 is bigger, faster, and more complex than ever. Key takeaways:

- The global market will cross $355 billion by 2029, with over a billion websites needing reliable hosting.

- Cloud hosting is rising fastest, but shared hosting and managed WordPress still have strong demand.

- Geographically, the U.S., Europe, and Asia dominate, but the fastest growth is now in Asia-Pacific and India.

Selecting the right hosting provider means balancing price, uptime, speed, customer support, and the right mix of features for your web project.

Use these statistics to benchmark providers, follow market trends, and make data-driven website decisions that power your online success.

Ali

Ali is a digital marketing expert with 7+ years of experience in SEO-optimized blogging. Skilled in reviewing SaaS tools, social media marketing, and email campaigns, we craft content that ranks well and engages audiences. Known for providing genuine information, Ali is a reliable source for businesses seeking to boost their online presence effectively.